Portsmouth mum reveals how Universal Credit has left her threatened with eviction and unable to feed her family

These are the heartbreaking words of a mum-of-two who has been pushed to the brink of poverty after being placed on the controversial welfare scheme.

Worried Emma Chisholm said within six weeks of getting her first payment, she was left so short of cash she was forced to go to a food bank.

Advertisement

Hide AdAdvertisement

Hide AdAnd the 30-year-old claimed the money coming from the new system was ‘nowhere near enough’ to cover her rent, leaving her hundreds of pounds in arrears and under the threat of eviction.

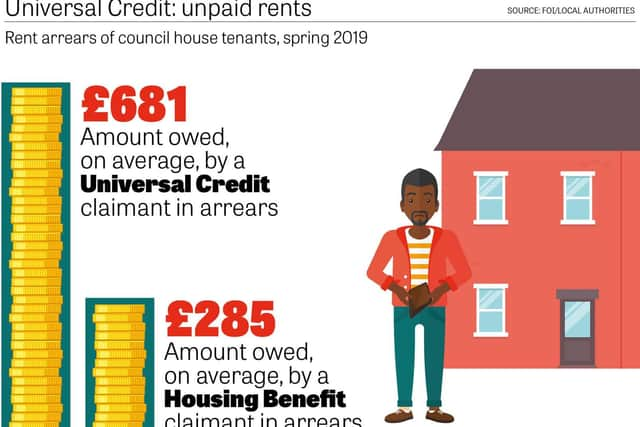

Her words come as an investigation by this paper and its parent company, JPIMedia, has revealed the shocking scale of Britain’s benefits crisis, with more than 95,000 people nationally on the new system now in debt – costing councils almost £63m in missed housing payments.

In a desperate bid to try and keep her family home, in Finchdean Gardens, Milton, Portsmouth, the part-time chambermaid has begged her parents and friends to loan her money and is now in the process of selling off her car.

‘It’s been a nightmare,’ said Mrs Chisholm. ‘Going to universal credit has been the worst decision of my life.

Advertisement

Hide AdAdvertisement

Hide Ad‘I thought I would be £8 a week better off on it but instead I’m in arrears, being threatened with eviction and struggling to pay my bills.

‘Things have become so bad I will have to sell my car to afford to live.

‘I have absolutely nothing left over at the end of the month. I’ve been left panicked and unable to sleep at night because of it.

‘It’s so hard to afford food for my two children that I’ve gone to a food bank for the first time in my life. That’s the most degrading thing ever.’

Advertisement

Hide AdAdvertisement

Hide AdMrs Chisholm decided to join the Universal Credit scheme earlier this year after taking an online assessment of how much benefit she would be entitled to.

She hoped it would give a better life to herself and her two boys, Harley, nine, and Archie, three.

Under her previous benefit arrangement, she used to receive £183 a week in child tax credit.

On top of her £134-a-week wage, she was left with £50 over at the end of the month to spend on emergency items like new clothes for the children.

Advertisement

Hide AdAdvertisement

Hide AdDuring her first few weeks of Universal Credit, she said she was given a cash advance totalling £1,400 for the month – money she said she spent mostly on rent and bills.

However, her next payment slumped to just £538 for the month, about £133 a week – £50 less than when she was on child tax credits.

‘After all my rent is paid, I’m left with just £338 a month to pay all my bills, food, fuel and car insurance. It’s just nowhere near enough,’ she said.

Mrs Chisholm’s landlord, Guinness Partnership, said it is looking at how it can help her out of arrears.

Advertisement

Hide AdAdvertisement

Hide AdBut a spokeswoman from the company said the 30-year-old’s situation wasn’t unique and that Guinness had seen a ‘noticeable’ increase in the number of people claiming Universal Credit who later fell behind on their rent.

A DWP spokesman said: ‘Research shows that many people join Universal Credit with pre-existing rent arrears, but this falls by a third after four months. Jobcentre staff work to verify housing costs as quickly as possible, to ensure people are paid their full housing entitlement.’